Many companies have a December year end. If you want to make your accountant happy follow these steps to make sure the books are complete and ready for year end.

- If you have inventory, count it and make a list of inventory on hand as at December 31.

- Invoice all your customers for December work and print a receivables list.

- Before January 15 print the payroll balancing report (PIER) and correct any errors.

- Keep the December bills and invoices separate from the January ones.

- Enter all December bills into accounts payable and print a payables list.

- Reconcile the bank account(s) and make copies of the reconciliation and bank statements.

- If you prepare the T4s make a copy of the T4 Summary.

- Make of copies of GST, PST, WCB returns, payroll remittances and any notices received from the government.

- Print or export the GL trial balance and general ledger detail to send to the accountant.

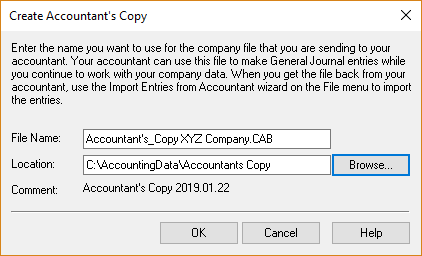

- Make a year end backup copy of accounting program data.